Trade In Transition!

We control the robots that act on behalf of our customers.

Introduction

A trading robot is a complex computer programme that automatically executes trading activities on a financial market.

It is used in conjunction with algorithmic trading, where trades are executed on the basis of mathematical models and rules. A trading robot can also use machine learning to improve the performance of the trading system and adapt to changing market conditions.

A trading bot can include an Order Management System (OMS) or an Execution Management System (EMS), which are used to place, monitor and manage trades. An OMS helps to organise and prioritise trades, while an EMS is responsible for executing trades in the market.

Another crucial component of a trading bot is its risk management system, which aims to minimize trading risks and maintain the integrity of the trading system. It establishes rules and limits that help manage trade risk effectively.

In summary, a trading bot automates and optimizes trading in financial markets by making rapid and precise decisions based on data and algorithms.

F&Q

Technic

Efficiency, stability and safety are the key basic requirements for the technology used.

Technology that makes the difference!

The success of our services depends not only on the algorithms, but also on the underlying technology infrastructure.

Our hardware architecture is meticulously designed to handle high data traffic and processing demands. Key factors such as energy efficiency and system stability are prioritized. Our technological approach ensures high throughput with low latency and maintains constant operational readiness through robust fail-safe mechanisms. This commitment to technical excellence allows us to meet the demands of today’s digital marketplace and tackle future challenges.

We utilize quantum sockets, which consist of high-performance micro-servers, for data acquisition and initial processing. The data generated is meticulously prepared before being fed into our indicator systems, which produce entry signals based on this information. The fully processed and analyzed data is then transmitted to our active trading bot. This bot, equipped with advanced algorithms and sophisticated AI technologies, automatically initiates and executes the corresponding trades.

Efficiency is more than just a buzzword for us; it is a fundamental guiding principle of our company. Our goal is not only to conserve resources and reduce costs through economically sensible measures but also to ensure the reliability of our technological infrastructure.

In the event of critical power outages, we are equipped to continue trading operations seamlessly. We are committed to sourcing our energy entirely from renewable sources, as sustainability and the promotion of clean energy are central to our values.

F&Q

Indicators

Stock market indicators provide the necessary data for automated decision-making, allowing trading robots to continuously make optimal trading decisions.

Signals that connect!

Our trading robots are based on a solid foundation of specifically selected indicators.

These indicators are mathematical and statistical measurement tools that are made up of various aspects of the market, including price, trading volume and general market activity. They serve as a barometer of the current market status in various time frames and provide in-depth insights into market conditions, such as whether a market is overbought or oversold. This information results in precise entry and exit points, which our trading robots integrate into their algorithmic strategy in order to make optimal trading decisions.

Stock market indicators are advanced statistical tools that traders and investors use to analyze and interpret the price movements of various financial instruments. However, even the most reliable indicators are not foolproof and can lead to misleading conclusions and potential losses, especially if they are not accurately calibrated to volatile market conditions.

This underscores the necessity for us to manage the trading robots for our clients. It enables us to dynamically adjust indicators during active trading, enhancing both the efficiency and accuracy of trading decisions while minimizing potential risks.

For our trading activities, we exclusively use our proprietary indicators, which are built upon highly successful existing indicators. These include:

Fragen und Antworten

Tradingbots

Börsenindikatoren liefern die notwendigen Daten für die automatisierte Entscheidungsfindung, wodurch Handelsroboter kontinuierlich optimale Handelsentscheidungen treffen können.

Bots, die handeln!

Für unsere Handelsaktivitäten setzen wir exklusiv auf unsere proprietären Trading-Algorithmen, die speziell für diese Aufgabe von unserem erfahrenen Entwicklerteam konzipiert und implementiert wurden.

Diese hoch spezialisierten Tradingbots ermöglichen es uns, unsere strategischen Ziele präzise umzusetzen und dabei die individuellen Anforderungen jedes einzelnen Kunden:innen zu berücksichtigen. In einem kontinuierlichen Optimierungsprozess werden diese Handelsalgorithmen laufend verfeinert und adaptiert, um so stets mit den dynamischen Veränderungen des Marktes Schritt zu halten.

Durch die kontinuierliche Anpassung unserer angewandten algorithmischen Logik können wir keine vorab festgelegten, bindenden Metriken zur Verfügung stellen, da sich die Ein- und Ausstiegspunkte ständig auf Grundlage der dynamischen Marktbedingungen verändern. Das maximale Drawdown-Risiko für eine einzelne Transaktion kann bis zu -5,6% erreichen. Diese Grenze repräsentiert unsere oberste Toleranzschwelle, die ein ausgewogenes Verhältnis zwischen potenzieller Rendite und angenommenem Risiko am besten abbildet.

Die Realisierung von Gewinnen variiert signifikant und ist stark abhängig von den gegenwärtigen Marktbedingungen. Sie starten bei einem Mindestwert von 0,5%, wobei das obere Limit nicht festgelegt ist und somit einen potenziell unbegrenzten Gewinn ermöglicht.

In einer Seitwärtsmarkt-Struktur, in der die Preise tendenziell innerhalb einer engen Bandbreite schwanken, setzen wir auf den Einsatz von Handelsrobotern, die Gewinne im Bereich von 0,5% bis 4,5% realisieren können.

Bei unseren Analysen, wenn wir eine bevorstehende Aufwärtsbewegung oder einen bullishen Markt prognostizieren, aktivieren wir Handelsroboter, die eine Trailing Stop Loss-Strategie verwenden. Diese Strategie ermöglicht es, die Position offen zu halten und die Gewinne wachsen zu lassen, solange der Preis steigt. Der Verkaufsauftrag wird erst dann ausgelöst, wenn eine festgelegte Preisänderung in die entgegengesetzte Richtung erkannt wird, was beispielsweise ein Hinweis darauf sein könnte, dass der Kaufdruck endgültig nachlässt. Dies maximiert unsere Gewinnpotenziale während der Aufwärtsbewegungen und schützt zugleich vor plötzlichen Marktrückgängen.

Fragen und Antworten

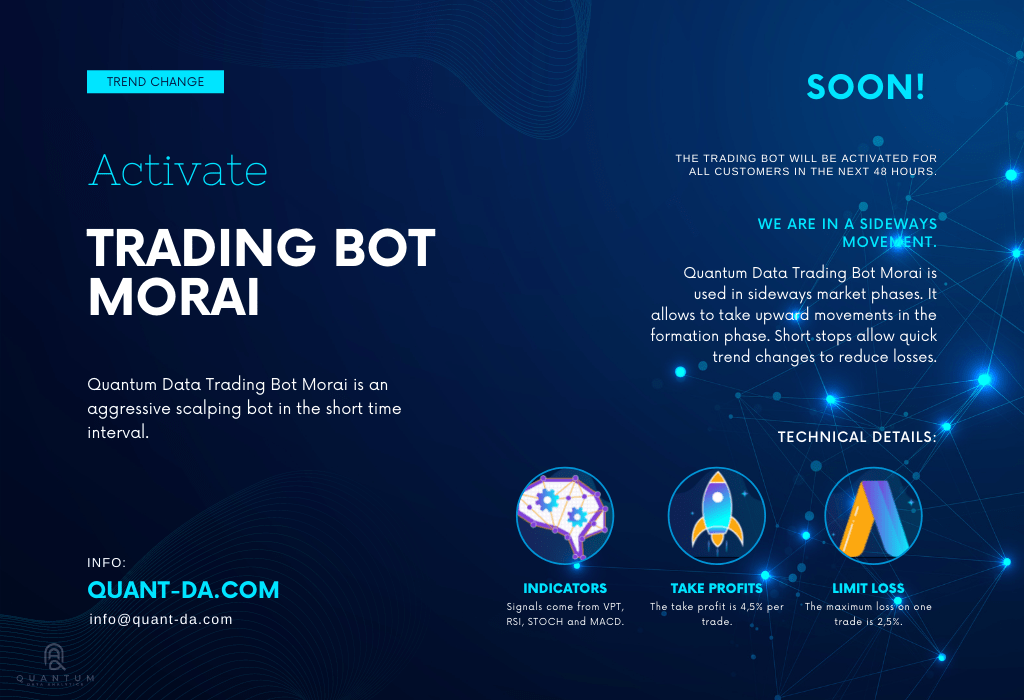

Morai

Der Morai Tradingbot ist spezialisiert auf Scalping-Strategien und agiert hauptsächlich innerhalb kurz- bis mittelfristiger Zeitfenster.

Die Handelssignale des Bots basieren auf den Daten von drei unterschiedlichen Indikatoren, die nicht zyklischen Mustern unterliegen, um eine zuverlässige und umfassende Marktanalyse zu gewährleisten. Der Drawdown des Bots ist variabel und auf maximal -2,5% begrenzt, was zusätzliche Sicherheit für Investoren bietet.

Morai strebt eine maximale Gewinnmitnahme von bis zu 6,3% an, wobei diese Zahl flexibel an die jeweiligen Marktbedingungen angepasst wird. Das Hauptziel des Bots ist es, in Seitwärtsmärkten nach signifikanten Verkaufsphasen von Gegenkorrekturen zu profitieren.

Eine wichtige Eigenschaft von Morai ist, dass alle drei Indikatoren gleichzeitig ein Kaufsignal aussenden müssen, bevor der Bot eine Handelsposition eröffnet. Diese strenge Bedingung sorgt für zusätzliche Sicherheit und Genauigkeit bei der Identifizierung von lukrativen Handelsmöglichkeiten.

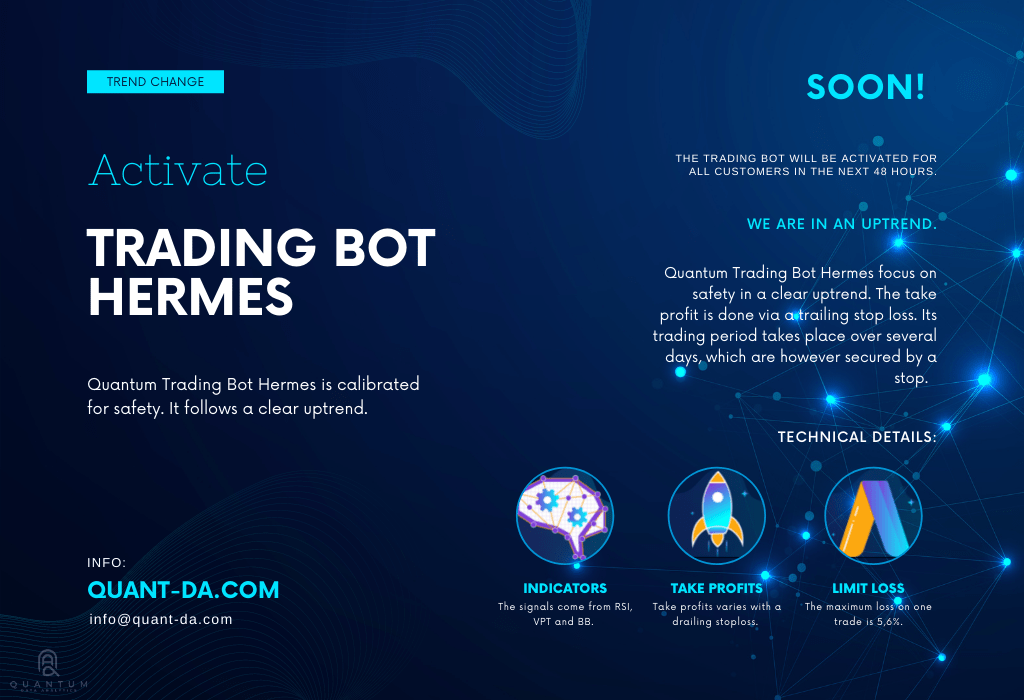

Hermes

Unser Handelsroboter Hermes ist auf langfristige Konsistenz und Stabilität konzipiert.

In puncto Risikomanagement beträgt der maximale Drawdown von Hermes -5,6%, wobei es gewisse Variationen bis zu diesem Punkt geben kann. Um den Kapitalerhalt weiter zu gewährleisten, ist Hermes zudem mit einer Trailing Stop Loss-Strategie ausgestattet. Abhängig von den aktuellen Marktbedingungen liegt diese zwischen -1% und -5% des erreichten Höchstkurses, was zusätzlich zur Optimierung der Gewinnmitnahme beiträgt und gleichzeitig potenzielle Verluste begrenzt.