Introduction

A trading robot is a complex computer program that automatically executes trading activities on a financial market. It is used in conjunction with algorithmic trading, where trades are executed based on mathematical models and rules. A trading robot can also use machine learning to improve the performance of the trading system and adapt to changing market conditions.

A trading bot can contain an Order Management System (OMS) or an Execution Management System (EMS), which are used to place, monitor and manage trades. An OMS helps organize and prioritize trades, while an EMS is responsible for executing trades in the market.

Another important component of a trading bot is the Risk Management System, which is used to minimize the risk of trades and ensure the integrity of the trading system. It can set rules and limits that help to limit the risk of trades.

Overall, a trading robot helps automate and optimize trading in a financial market by making fast and accurate decisions based on data and algorithms.

In total, we have developed six trading bots that are adapted to the respective market situation. If we detect a trend, we calibrate and activate the designated trading bot and control it. Over time, more trading bots will be added and combined with existing ones.

Normally, yes. Exceptions are unpredictable market situations and looming market crashes. It can happen that the trading bots are active during a crash, but this depends on the current situation and the assessment of the risk-reward ratio. Trading bots are also deactivated during maintenance, but these are rare and of short duration. We announce every change beforehand via mail and in the social communities!

Yes, this can happen and unfortunately we can never rule out technical difficulties. We have developed all our systems ourselves and know their weak points. Therefore, we can immediately react accordingly in case of failures. In addition, security measures are always active in the background. For example, if there is a serious problem, all current orders are cancelled so that customer funds in the respective stock market accounts remain protected against possible losses.

Technic

The success of our services depends not only on the algorithms, but equally on the underlying technology infrastructure. Our entire hardware architecture is specifically designed for high traffic and data processing requirements. Critical factors such as energy efficiency and system stability are paramount. Our technological approach enables high throughput at low latency and guarantees steady operational readiness through robust failover measures. This commitment to technical excellence enables us to meet the demands of today’s digital marketplace as well as future challenges.

Efficiency, stability and safety are the key basic requirements for the technology used.

For the acquisition and initial processing of the data, we use quantum sockets consisting of high-performance micro servers. This generated data undergoes careful processing and is then fed to the indicator systems, which generate the entry signals based on this data. Subsequently, the final processed and analyzed data is transmitted to our active trading bot. This then initiates the corresponding trade and executes it fully automatically, supported by sophisticated algorithms and advanced AI technologies.

Efficiency is not just a buzzword for us, but a key guiding principle in our operations. Our aim is not only to conserve resources and reduce costs through economically sensible measures, but also to ensure the reliability of our technological infrastructure. Even in scenarios of critical power outages, we are able to continue trading operations without interruption. In doing so, we ensure that our energy supply comes entirely from renewable sources, as sustainability and the promotion of clean energies are close to our hearts.

No. All the computing power we need directly or indirectly is provided entirely by our own hardware. This is expensive, but the advantages greatly outweigh the disadvantages. We do not run the risk of customer data being passed on, for example!

We are sorry, but for security reasons we do not want to give details. However, we can say that our technique is extensive and covers all facets. Therefore, we paraphrase our technique and rather clarify according to which guidelines we work.

Yes, it can of course fail. We therefore do a lot to ensure that our technology is prepared for all eventualities. As already described, we are able to continue operation at base load in the event of a power failure. In the event of a failure of the technology, we have appropriate replacements and multiple distributed backups!

Indicators

The Signals

Our trading robots are built on a solid foundation of specifically selected indicators. These indicators are mathematical-statistical measurement tools composed of various aspects of the market, including price, trading volume and general market activity. They serve as barometers of the current market status over diverse time periods and provide deep insights into market conditions, such as whether a market is overbought or oversold. This information results in precise entry and exit points, which our trading robots incorporate into their algorithmic strategy to make optimal trading decisions.

Stock market indicators are sophisticated statistical tools that traders and investors use to study and interpret the price dynamics of various financial instruments. However, even the best indicators are not infallible and, especially if not precisely tuned to volatile market conditions, can be misguided and cause potential losses. This underscores the need for us to take control of trading robots for our clients. It allows us to dynamically adjust indicators during the active trading process, which improves both the efficiency and accuracy of trading decisions and helps minimize potential risks.

For our trading we use only our own indicators, which are already based on very successful indicators. These include:

The Relative Strength Index (RSI) is an indicator that measures the relative strength of a financial instrument compared to its own past. It is used to identify potential buy and sell signals.

The Volume Price Trend (VPT) is an indicator that measures the relationship between price and volume changes. It is used to capture the dynamics of price movements and identify potential buy and sell signals.

The Moving Average Convergence Divergence (MACD) is an indicator that measures the dynamics of price movements by calculating the difference between two moving averages. It is used to identify potential buy and sell signals.

The Bollinger Bands are an indicator that measures the volatility of a financial instrument. They are used to identify potential buy and sell signals and to determine whether a price is overbought or undervalued.

Stochastic is an indicator that measures the relative position of the current price compared to the price range of a given period. It is used to identify potential buy and sell signals and to determine whether a price is overbought or undervalued.

Trading Bots

For our trading activities, we exclusively rely on our proprietary trading algorithms, which have been designed and implemented specifically for this task by our experienced team of developers. These highly specialized trading bots enable us to precisely implement our strategic goals while taking into account the individual requirements of each client. In a continuous optimization process, these trading algorithms are constantly refined and adapted to keep pace with the dynamic changes of the market.

The trading robots carry out the buying and selling. We scale the conditions for this according to the market conditions!

Due to the continuous adjustment of our applied algorithmic logic, we cannot provide pre-set binding metrics as entry and exit points are constantly changing based on dynamic market conditions. The maximum drawdown risk for a single transaction can reach as low as -5.6%. This limit represents our upper tolerance threshold that best represents a balance between potential return and assumed risk.

The realization of gains varies significantly and is highly dependent on current market conditions. They start at a minimum of 0.5%, with an upper limit that is not fixed and thus allows for potentially unlimited gains.

In a sideways market structure, where prices tend to fluctuate within a narrow range, we rely on the use of trading robots that can realize profits in the range of 0.5% to 4.5%.

In our analyses, when we forecast an upcoming upward movement or a bullish market, we activate trading robots that use a trailing stop loss strategy. This strategy allows us to keep the position open and let the profits grow as long as the price is rising. The sell order is triggered only when a specified price change in the opposite direction is detected, which could be an indication that buying pressure is finally subsiding, for example. This maximizes our profit potential during upward movements while protecting against sudden market declines.

The trading bots need clear buy signals and as long as they are not present to a sufficient degree, the trading bot will not trade. It can happen that the trading bots do not trade for days, or are deactivated due to a market correction. The goal is not to trade as much as possible, but the one that generates profits.

This can have several reasons. Normally, the pain threshold of the loss has not yet been reached. In the rarest cases, there is technical or human failure. For this we have an EMERGENCY STOP! If there are problems, the last command is to sell all open orders, so that the customer’s funds are protected from subsequent possible price drops.

The START-STOP page displays the current status of the trading bot. Likewise in the member area and on the start page. Whether the trading bot is active or inactive is shown in the header on all pages of our platform.

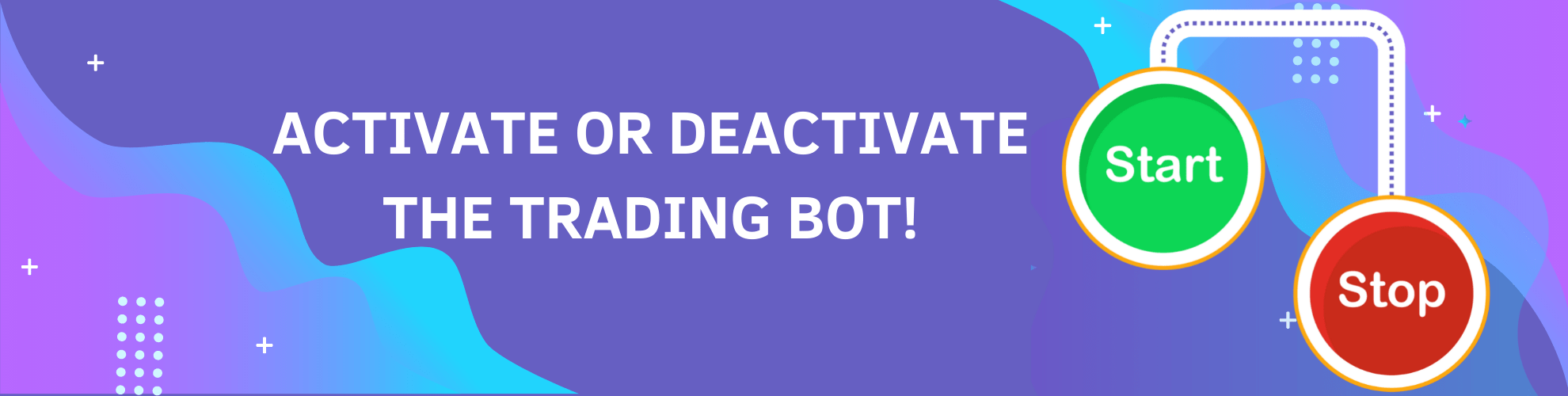

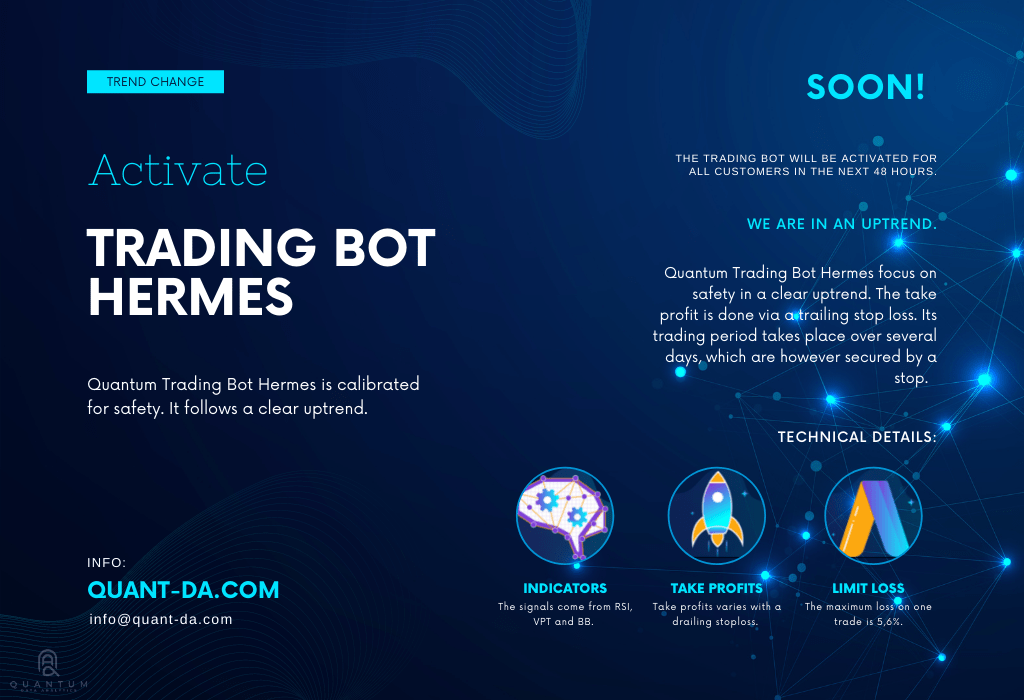

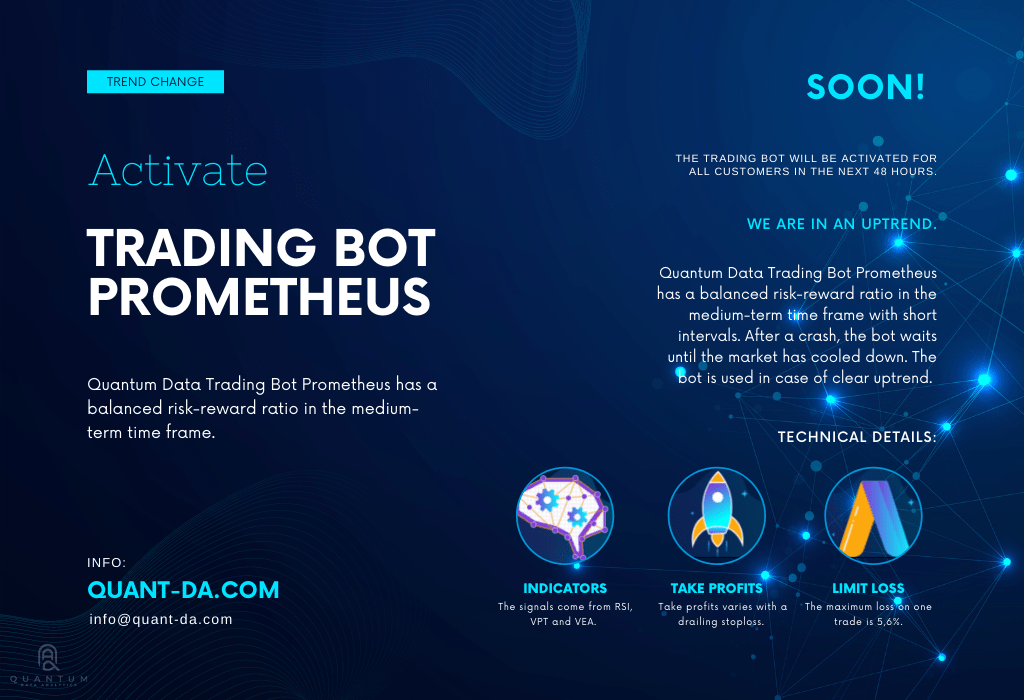

If we switch the trading bot, our customers will be notified promptly via mail. In the social networks, the changeover will be announced 48 hours before the activation.

Our trading robot Hermes is designed for long-term consistency and stability. It uses a combination of cyclical pattern recognition and technical indicators to generate its trading signals, with a particular focus on risk management and capital preservation. Hermes is primarily used in confirmed bull markets where sustained upside is forecast. It acts as a signal generator for the possible formation of a prominent low in a given asset.

In terms of risk management, Hermes’ maximum drawdown is -5.6%, although there may be some variation up to this point. To further ensure capital preservation, Hermes is also equipped with a trailing stop loss strategy. Depending on the current market conditions, this ranges between -1% and -5% of the highest price reached, which additionally helps to optimize profit taking while limiting potential losses.

The Morai trading bot specializes in scalping strategies and operates mainly within short to medium term time frames. It is particularly effective in uncertain market phases where sideways movements dominate. The bot is equipped with predefined parameters for profit realization and loss limitation to ensure effective risk management.

The bot’s trading signals are based on data from three different indicators that are not subject to cyclical patterns to ensure reliable and comprehensive market analysis. The drawdown of the bot is variable and limited to a maximum of -2.5%, which provides additional security for investors.

Morai aims for a maximum profit-taking of up to 6.3%, with flexibility to adjust this figure according to market conditions. The main objective of the bot is to profit from counter corrections in sideways markets after significant periods of selling.

An important feature of Morai is that all three indicators must send a buy signal simultaneously before the bot opens a trading position. This strict condition provides additional security and accuracy in identifying lucrative trading opportunities.

Prometheus, our specialized trading bot, is strategically designed with a sophisticated risk/reward ratio. Specifically, it is calibrated to operate during periods of increased volatility, which are typical at the end of a bull cycle. As an indicator-driven trading bot, Prometheus works within a medium-term timeframe, employing a dynamic selling strategy that utilizes a trailing stop loss order. Based on the purchase price, the maximum drawdown is -5.6%, reflecting a moderately controlled risk. By using a trailing stop loss, the take profit point varies, but is capped at a maximum of -2.5% below its recent high. This mechanism allows for flexible adaptation to market changes, thereby enabling optimal exploitation of profit potentials.

QUANTUM DATA TRADING

“You win, we win – Our success is based on your commission! And that is 10% of your net profit!”

Worldwide trading!

Currently we offer Binance, but soon we will add other trading venues like Coinbase.

Unlimited Signals

All buy and sell signals are included in the package. There are no extra or additional costs!

24 hours, 365 days!

We trade around the clock, holidays and weekends, 365 days a year.