Quantum Data Analytics 2024: A new era for financial analysis and trading - published in FinMag.fr.

From Marie-Ange Nodar

Can you introduce us to Quantum Data Analytics?

As pioneers in the development and application of trading robots and analytics, we at Quantum Data Analytics stand for innovation and self-sufficiency in financial technology. Our journey began with the belief that inspiration and innovation are the driving forces that can revolutionize the world of finance.

From the beginning, we have focused on developing every tool, strategy, and algorithm in our portfolio in-house. Our dedicated in-house development team works tirelessly to create customized solutions that can respond precisely to the ever-changing demands of digital markets. This independence and our innovative approach allow us to respond flexibly and effectively to the dynamics of the markets.

Our advanced trading robots, powered by artificial intelligence, operate with unrivaled precision and efficiency. This cutting-edge technology enables us to consistently achieve optimal trading results. We take full control of the robots for our clients, so you can sit back and relax while your investments are managed effectively and worry-free.

The core of our success lies in our in-depth and multifactorial market analyses. We combine traditional methods with innovative techniques such as regression analysis, time series forecasts, and sentiment analyses to create precise market forecasts. These well-founded insights form the basis for the development of our trading strategies and enable us to generate sustainable returns. Our efforts are paying off: averaging more than three percent profit per month, we achieve an impressive annual return of over 42%.

Our story is one of innovation and success. At Quantum Data Analytics, we pride ourselves on being at the forefront of technological development, pushing financial technology forward through our trading robots and our relentless dedication to perfection and efficiency. When inspiration meets innovation, solutions are created that shape the future of financial markets.

Origin?

The basic idea of Quantum Data Analytics was born in 2018, when Erik Wimmer, the founder of our company, began his journey into the world of digital assets. Originally involved in forex trading, Erik quickly recognized the enormous technical potential that digital markets offered. He was so captivated by the idea of combining simple software with a stock market account to simplify trading and make it more scalable that Quantum Data Analytics was born.

Our journey took off, and by 2020, our first trading robot began automated stock market trading. Under constant monitoring, we continuously improved efficiency with the data obtained. In the same year, we also developed the first regression analyses, which have continued to evolve in various areas to this day.

2021 was a decisive year for us. We decided to officially found Quantum Data Analytics to share our successes to date with customers worldwide. The launch of our first website followed in 2022, along with trading for selected test customers. Extensive testing not only improved our trading robots but also our client management system, which is closely linked to our trading system. In total, we developed and tested six trading robots that are suitable for all market phases.

We successfully completed our test phase in 2024 and officially launched Quantum Data Analytics. Getting there was by no means easy - we had to constantly rethink our ideas and overcome technical challenges. But with every challenge, we grew, learned, and improved our technologies. Today, we are ready to offer our customers an innovative, reliable, and efficient solution for automated trading.

What does analyzing quantitative data make possible?

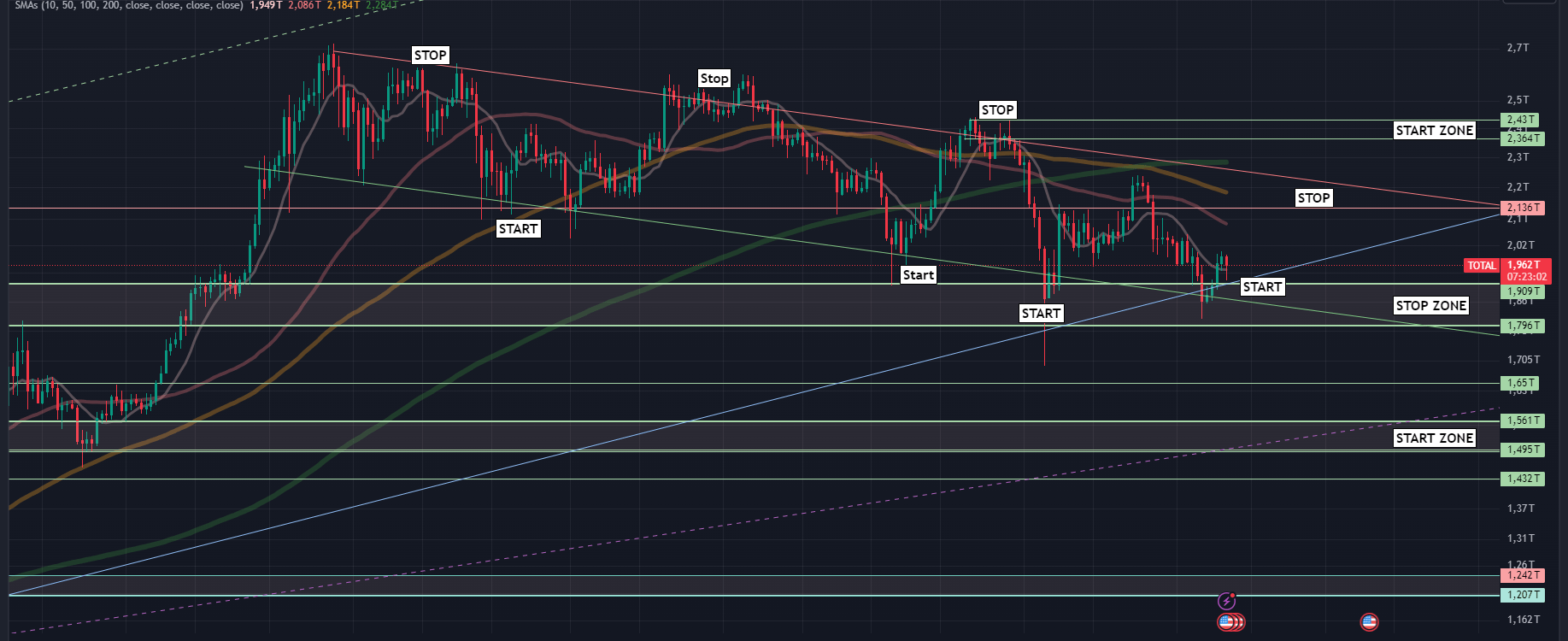

When certain key figures from on-chain data are combined with quantitative market data, a three-dimensional picture emerges that goes far beyond the conventional two-dimensional analysis with purely quantitative data. On-chain data, which includes the network data of the blockchain of the respective assets and is also used by brokers, provides in-depth insights into the vitality of the network and the reserves on the exchanges.

One example of this is analyzing the transfer activity of assets. If assets are increasingly being transferred from private addresses to trading centers, this indicates that the sell side is increasing and selling pressure is expected soon. Conversely, if assets are withdrawn from the exchanges, the reserves on the trading centers decrease, which could lead to increased buying pressure if the buying mood is right.

By integrating this on-chain data into our analysis, we can directly mirror supply and demand with the quantitative data and paint a more in-depth picture than conventional chart analyses. On this basis, models such as regression analyses and time series models can be created which, in conjunction with sentiment analyses from social networks, provide a very precise picture of the market situation.

We use this extensive and precise data to calibrate our trading robots. Thanks to this method, our robots can react extremely precisely to market conditions and thus achieve optimal trading results. This enables us to offer our clients an innovative and efficient trading solution based on the most up-to-date and accurate data.

Benefit from our trading success! Simply register and you're ready to go!

Which clients are you targeting?

Our offering is aimed at all classes of investors who are already invested or considering investing in the digital markets. Our service offering is tailored for both retail and institutional investors, so everyone can benefit from our customised options.

Quantum offers two specialised management options: ‘Quantum Exclusive’ and ‘Quantum Professional’. ‘Quantum Exclusive’ allows investors to take advantage of a collective account that offers efficient management and maximum flexibility. ‘Quantum Professional’, on the other hand, is aimed at investors with an individual customer account with a volume of €10,000 or more, in order to guarantee customised solutions and personal support.

Our remuneration structure is performance-based and is set at 10% of the net profit we realise within a 30-day settlement period. This dynamic fee ensures that our objectives are always aligned with our clients' financial interests. In this way, our clients benefit directly from our expertise and commitment to achieving optimal trading results.

What's the latest news? Prospects?

Following the successful launch of Quantum Data Analytics, we have planned several phases to ultimately establish our place as a market maker. Over time, we will continuously introduce innovations, including the development of our own app and the further enhancement of our website to make our service even more accessible and user-friendly for our customers.

A key component of our growth strategy is the establishment of our own distribution system. This will strengthen us sustainably and secure our long-term growth. Simultaneously, we are seeking strategic partnerships to bolster and further expand our sales organization worldwide. With every milestone we reach, we consolidate our position and lay the foundations for the next step.

Our aim is to utilize these targeted measures and continuous improvements to consolidate our position as a leading player in the digital markets and continue to offer our customers first-class services.