TRADE

IN TRANSITION

We control the robots that act on behalf of our customers.

Introduction

A trading robot is a complex computer programme that automatically executes trading activities on a financial market.

It is used in conjunction with algorithmic trading, where trades are executed on the basis of mathematical models and rules. A trading robot can also use machine learning to improve the performance of the trading system and adapt to changing market conditions.

A trading bot can include an Order Management System (OMS) or an Execution Management System (EMS), which are used to place, monitor and manage trades. An OMS helps to organise and prioritise trades, while an EMS is responsible for executing trades in the market.

Another crucial component of a trading bot is its risk management system, which aims to minimize trading risks and maintain the integrity of the trading system. It establishes rules and limits that help manage trade risk effectively.

In summary, a trading bot automates and optimizes trading in financial markets by making rapid and precise decisions based on data and algorithms.

Q&A

Technology

Efficiency, stability and safety are the key basic requirements for the technology used.

Technology that makes the difference!

The success of our services depends not only on the algorithms, but also on the underlying technology infrastructure.

Our hardware architecture is meticulously designed to handle high data traffic and processing demands. Key factors such as energy efficiency and system stability are prioritized. Our technological approach ensures high throughput with low latency and maintains constant operational readiness through robust fail-safe mechanisms. This commitment to technical excellence allows us to meet the demands of today’s digital marketplace and tackle future challenges.

We utilize quantum sockets, which consist of high-performance micro-servers, for data acquisition and initial processing. The data generated is meticulously prepared before being fed into our indicator systems, which produce entry signals based on this information. The fully processed and analyzed data is then transmitted to our active trading bot. This bot, equipped with advanced algorithms and sophisticated AI technologies, automatically initiates and executes the corresponding trades.

Efficiency is more than just a buzzword for us; it is a fundamental guiding principle of our company. Our goal is not only to conserve resources and reduce costs through economically sensible measures but also to ensure the reliability of our technological infrastructure.

In the event of critical power outages, we are equipped to continue trading operations seamlessly. We are committed to sourcing our energy entirely from renewable sources, as sustainability and the promotion of clean energy are central to our values.

Q&A

Indicators

Stock market indicators provide the necessary data for automated decision-making, allowing trading robots to continuously make optimal trading decisions.

Signals that connect!

Our trading robots are based on a solid foundation of specifically selected indicators.

These indicators are mathematical and statistical measurement tools that are made up of various aspects of the market, including price, trading volume and general market activity. They serve as a barometer of the current market status in various time frames and provide in-depth insights into market conditions, such as whether a market is overbought or oversold. This information results in precise entry and exit points, which our trading robots integrate into their algorithmic strategy in order to make optimal trading decisions.

Stock market indicators are advanced statistical tools that traders and investors use to analyze and interpret the price movements of various financial instruments. However, even the most reliable indicators are not foolproof and can lead to misleading conclusions and potential losses, especially if they are not accurately calibrated to volatile market conditions.

This underscores the necessity for us to manage the trading robots for our clients. It enables us to dynamically adjust indicators during active trading, enhancing both the efficiency and accuracy of trading decisions while minimizing potential risks.

For our trading activities, we exclusively use our proprietary indicators, which are built upon highly successful existing indicators. These include:

Q&A

Trading bots

Stock market indicators supply crucial data for automated decision-making, enabling trading robots to consistently execute optimal trades.

Bots that trade!

For our trading activities, we rely exclusively on our proprietary trading algorithms, which were designed and implemented specifically for this task by our experienced team of developers.

These highly specialized trading bots allow us to precisely execute our strategic objectives while accommodating the unique needs of each client. Through a continuous optimization process, these trading algorithms are regularly refined and adjusted to stay aligned with the dynamic shifts in the market.

Due to the continuous refinement of our algorithmic logic, we are unable to provide fixed, binding metrics, as entry and exit points fluctuate based on dynamic market conditions. The maximum drawdown risk for a single transaction can reach up to -4.6%. This limit represents our upper tolerance threshold, balancing potential returns with assumed risk.

The realization of gains varies significantly and depends heavily on current market conditions. Returns start at a minimum of 0.5%, with no fixed upper limit, allowing for the possibility of unlimited profit.

In a sideways market, where prices fluctuate within a narrow range, we deploy trading robots designed to capture profits between 0.5% and 4.5%

When our analysis predicts an imminent upward movement or a bullish market, we activate trading robots that utilize a trailing stop-loss strategy. This approach allows positions to remain open and profits to increase as long as the price continues to rise. The sell order is triggered only when a specified price movement in the opposite direction is detected, signaling that buying pressure may be waning. This method maximizes profit potential during upward trends while simultaneously safeguarding against sudden market downturns.

Q&A

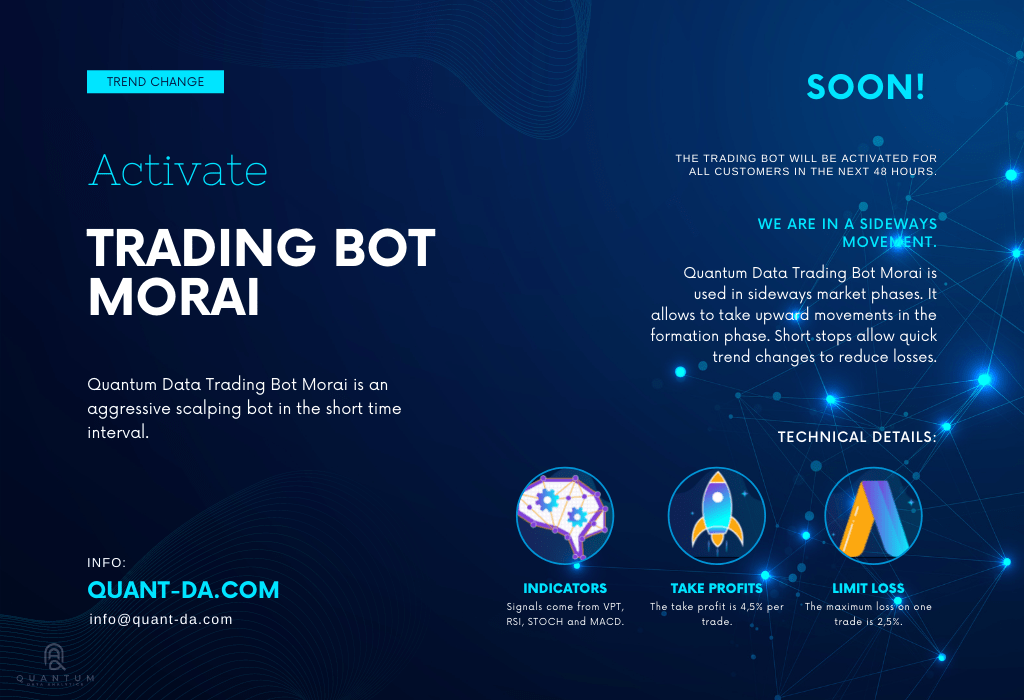

Morai

The Morai Tradingbot specialises in scalping strategies and operates mainly within short to medium-term time frames.

The bot's trading signals are derived from three distinct indicators that are not influenced by cyclical patterns, ensuring reliable and comprehensive market analysis. Its drawdown is adjustable but capped at a maximum of -2.5%, offering added security for investors.

Morai targets a maximum profit of up to 6.3%, with this figure being flexibly adjusted to prevailing market conditions. The bot’s primary objective is to capitalize on counter-corrections during sideways markets, particularly following significant sell-offs.

A key feature of Morai is that all three indicators must simultaneously trigger a buy signal before a trading position is opened. This strict requirement adds an extra layer of security and precision in identifying profitable trading opportunities.

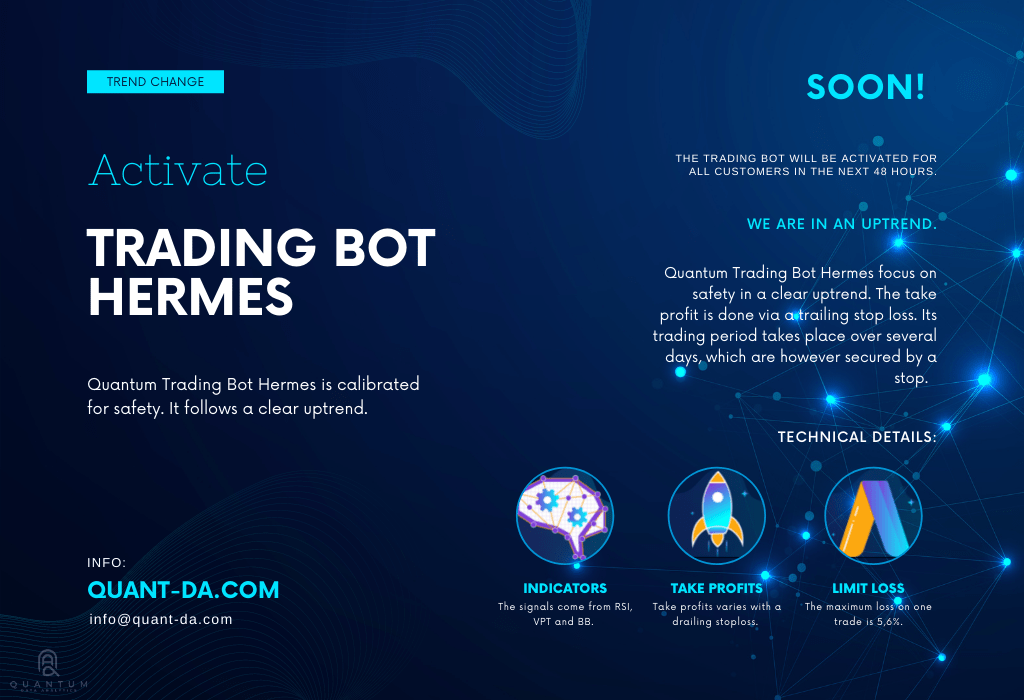

Hermes

Our Hermes trading robot is designed for long-term consistency and stability.

In terms of risk management, Hermes' maximum drawdown is capped at -5.6%, though some fluctuations may occur within this range. To further safeguard capital, Hermes incorporates a trailing stop-loss strategy, which adjusts based on market conditions. This stop-loss typically ranges from -1% to -5% of the asset’s peak price, optimizing profit-taking while limiting potential losses.