QUANTUM TRADINGBOTS

RESULTS

THE RESULTS!

All trading results from Quantum Data Analytics!

Quarter 1 Year 2025

Performance

Trading Volume

Trading Days

Trading Report Quarter 1 Year 2025

Trading Report – April 2025

Following a successful trading cycle with a 46% return in Q4 2024, we exited all open positions on December 14, 2024, and have since remained completely on the sidelines. In a declining market, we follow one principle above all: “Not trading is also a trade.”

Looking back, this decision proved to be the right one. Since December 17, 2024, the digital asset market has entered a clear correction phase, exacerbated by increasing uncertainty. Our strategy during this time has been capital preservation and observation, allowing us to increase our available trading volume—measured against the last exit price—by more than 100%.

Market Analysis Based on the Chart

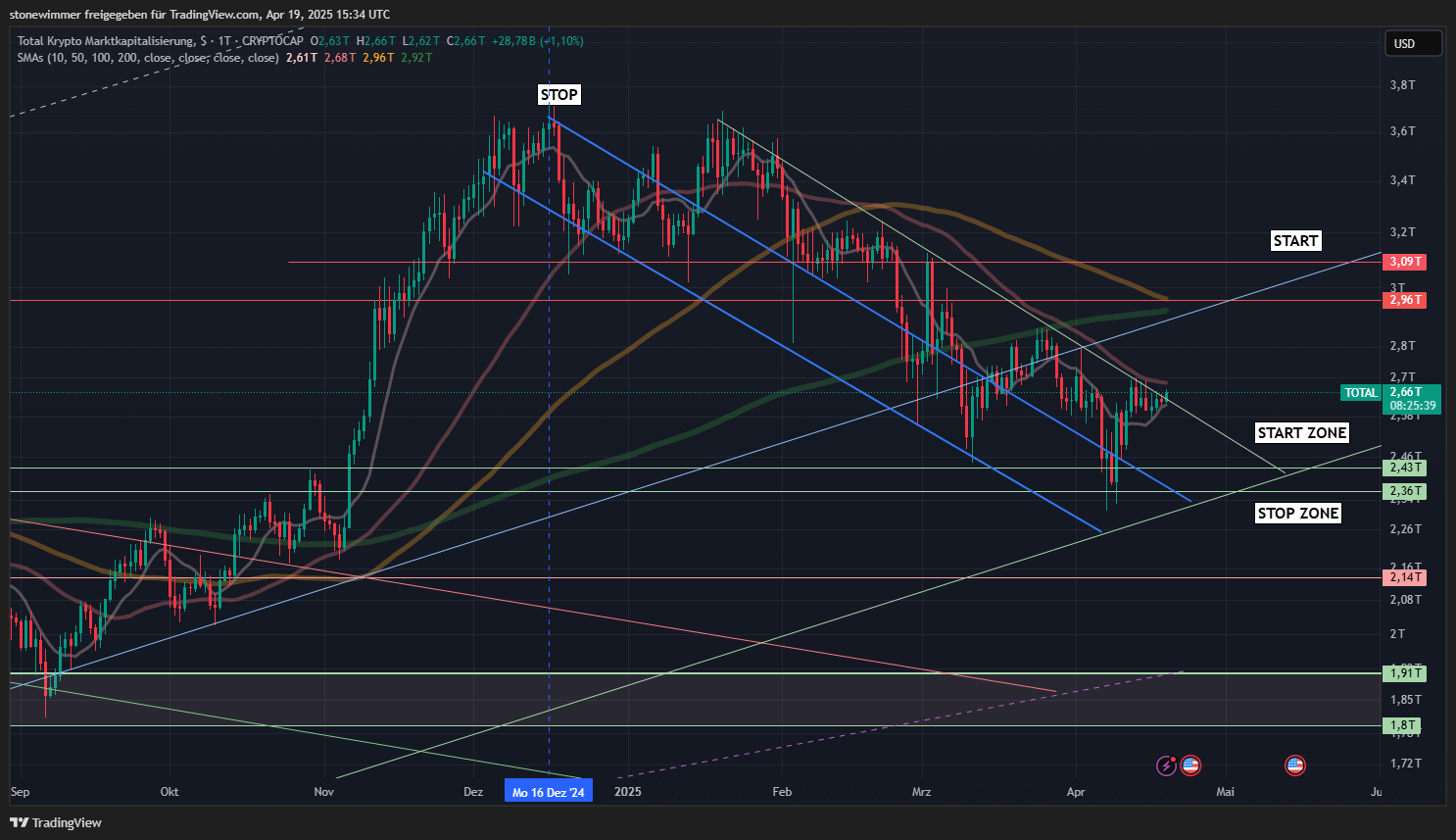

The attached chart clearly illustrates the current state of the Total Crypto Market Capitalization:

-

Downward Trend Channel (blue): Since the all-time high in November 2024, the market has established a well-defined downward trend, which has yet to be sustainably broken. The market has moved within this channel for several months.

-

Moving Averages (SMA 50/100/200): All key SMAs (red, orange, green) are currently positioned above the market price (~2.66T USD), indicating weak momentum. Especially the SMA200 represents a strong resistance.

-

Start and Stop Zones:

-

The START ZONE at approximately 2.43–2.46T USD has held up but hasn’t yet triggered a reliable breakout.

-

The STOP ZONE near 2.14T USD marks a critical support level.

-

A potential new cycle could begin only once the 2.96–3.09T USD range is convincingly broken, which also marks the upper edge of the downward channel intersecting with the SMA200.

-

Current Market Challenges

At present, several factors make it difficult to re-activate our trading algorithm Morai 1.5:

-

US Trade Policy: The unpredictable decisions of the U.S. President regarding tariffs and trade agreements have made reliable macroeconomic forecasting virtually impossible. Decisions are often reversed within minutes, creating an unstable environment with no clear trends.

-

Geopolitical Risk: A potential military conflict between the U.S. and Iran has become increasingly plausible. The heavy deployment of U.S. military forces around Iran is a serious warning sign.

-

Federal Reserve Interest Rate Policy: Although the Fed has ended its balance sheet reduction, it remains reluctant to lower interest rates. According to the CME FedWatch Tool, the first rate cut of 25 basis points is currently priced in at 54% for June 2025. The market expects up to five cuts this year – a divergence that creates additional uncertainty.

Hopes for a Short-Term Recovery

Despite these challenges, we are seeing some early signs of a potential rebound:

-

Oversold Conditions: Multiple daily indicators, such as RSI and MACD, point to a strongly oversold market.

-

Increased Probability of a Short-Term Rally: A potential bottom is forming within the lower part of the trend channel. A breakout from the descending channel is becoming more likely.

-

Ready to Act: We are fully prepared to re-enter the market the moment a clear signal emerges. We will initially open partial positions, and once profits are secured, we plan to follow up with a second correlated asset. As always, targets and strategies will be published in the client area.

Conclusion

We do not yet see a sustainable uptrend, but we are preparing for extended bear market rallies, which can offer short-term opportunities. A longer cycle of rising prices is not currently in sight, given the macroeconomic uncertainties.

Yet as always in the markets: conditions can change at any time. We remain alert and patient. When the signals align, Morai 1.5 will resume its work immediately—strategically, cautiously, and fully equipped.

Trading Report Quarter 4 Year 2024

In September 2024, we proudly announced the official trading launch of Quantum Data Analytics following four years of intensive development. However, in light of geopolitical risks and unfavorable market conditions, we chose to postpone the start of actual trading until the end of October. This deliberate and cautious approach enabled us to thoroughly analyze the market environment and make well-informed decisions.

Market Overview and Trading Strategy

October 2024

Throughout October 2024, we maintained a cautious stance and refrained from entering the market due to the ongoing decline in digital asset prices. It was only at the end of the month that we identified initial buy signals, prompting us to cautiously build positions in ADA, XRP, and VET. Concurrently, we monitored the US presidential election, as its outcome was expected to significantly influence market sentiment.

November 2024

The unexpected victory of Donald Trump in the US presidential election sparked significant market euphoria, as he emerged as an unanticipated advocate for digital assets. This shift strengthened expectations for a positive long-term trend in the digital asset market.

Starting in early November, we increased our trading activity to capitalize on the buoyant market sentiment. We initially correlated ADA with XRP and executed a targeted trade on a previously analysed breakout in VET. However, due to conflicting signals, we adjusted our strategy to focus exclusively on ADA and XRP, a decision that proved to be highly effective.

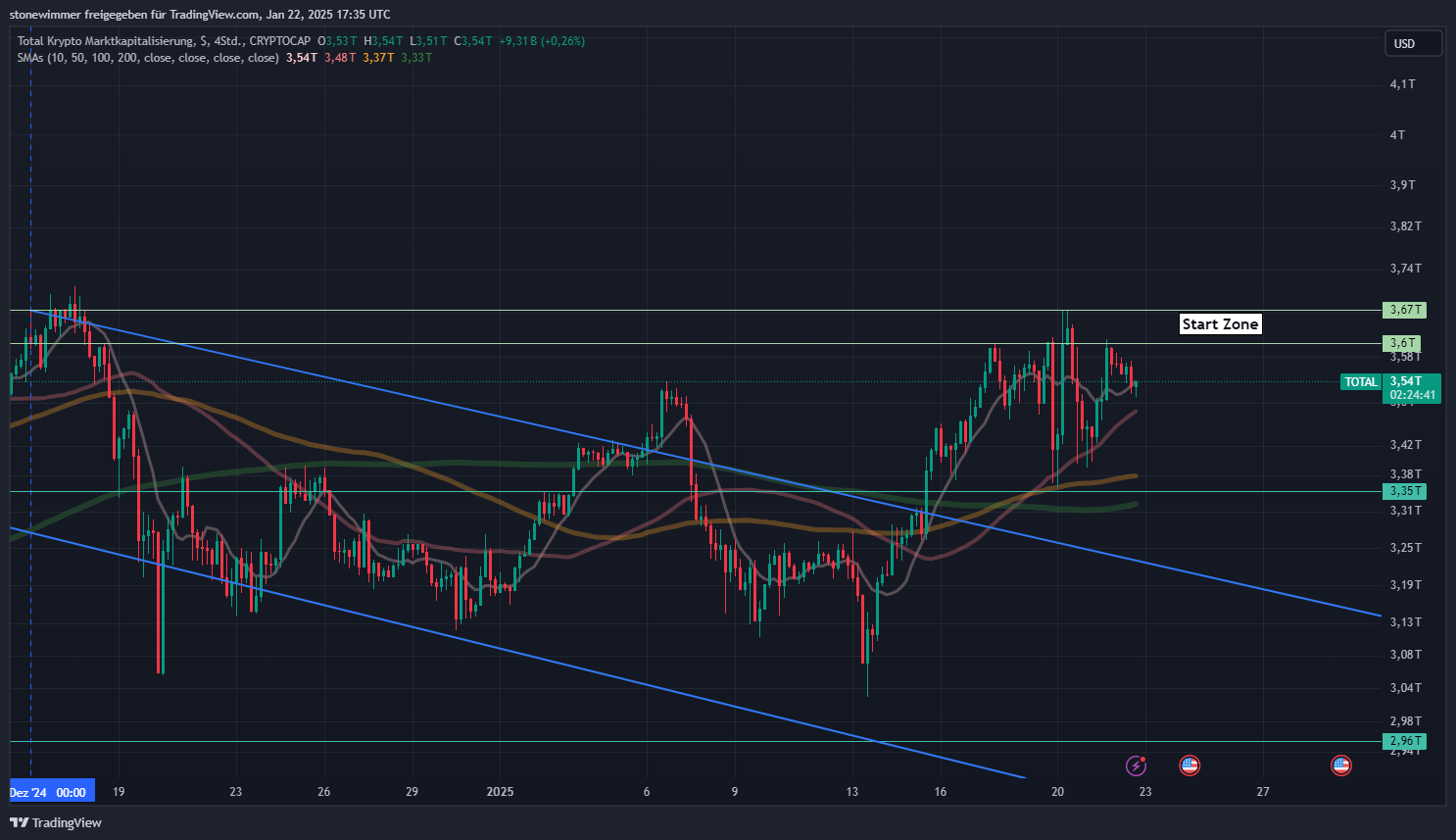

Chart Analysis Quarter 4

December 2024

Technical chart analyses pointed to an imminent rise in Ethereum's price, bolstered by several technical developments and milestones. However, critical voices ensured that a new all-time high was not achieved.

In anticipation of a significant market correction around December 16, we ceased trading on December 14 as a precautionary measure and liquidated all open positions, retaining only the minimum holdings required for trading eligibility. This decision proved to be the right one, as the market experienced a noticeable decline starting December 17, entering a downward trend channel. Since their recent highs, the assets we traded have lost up to 30% of their value.

Results

Performance

During the trading period from October 29 to December 14, 2024, we achieved an impressive return of 46%. Our trading volume reached USDT 12,141,077.46.

Technical Implementation

The technical execution of our trades proceeded seamlessly. Signal quality was consistently excellent, and data processing was punctual and precise. This highlights the efficiency and reliability of our systems.

Conclusion and Outlook

Despite a delayed start to trading, we achieved remarkable success in the fourth quarter of 2024. Our conservative initial approach, combined with agile adjustments to market developments, allowed us to generate a significant return while effectively managing risks.

Looking ahead, we anticipate continued positive trends in the digital asset market, especially under the new political landscape in the United States. We remain confident that our strategic planning and robust technical infrastructure will secure a lasting competitive edge in the future.

Archive 2024

Quartal 1

Kein Handel!

Quartal 2

Kein Handel!

Quartal 3

Kein Handel!

Quartal 4

Profit: 46%

Volumen: 12.141.077,46 $

Handelstage: 47