FinMag.fr – Quantum Data Analytics in Fokus

24. June 2024

Market analysis and strategic deployment plan for trading robot Morai 1.5

20. April 2025How we activate and deactivate our trading systems!

In times of uncertainty and significant market corrections, it is particularly important to develop detailed chart analyses in order to identify clear trends.

One of the most crucial metrics in this context is total market capitalization, which has a significant impact on our trading strategy. It provides insights into overall market sentiment, helping us decide when to activate or deactivate our trading systems.

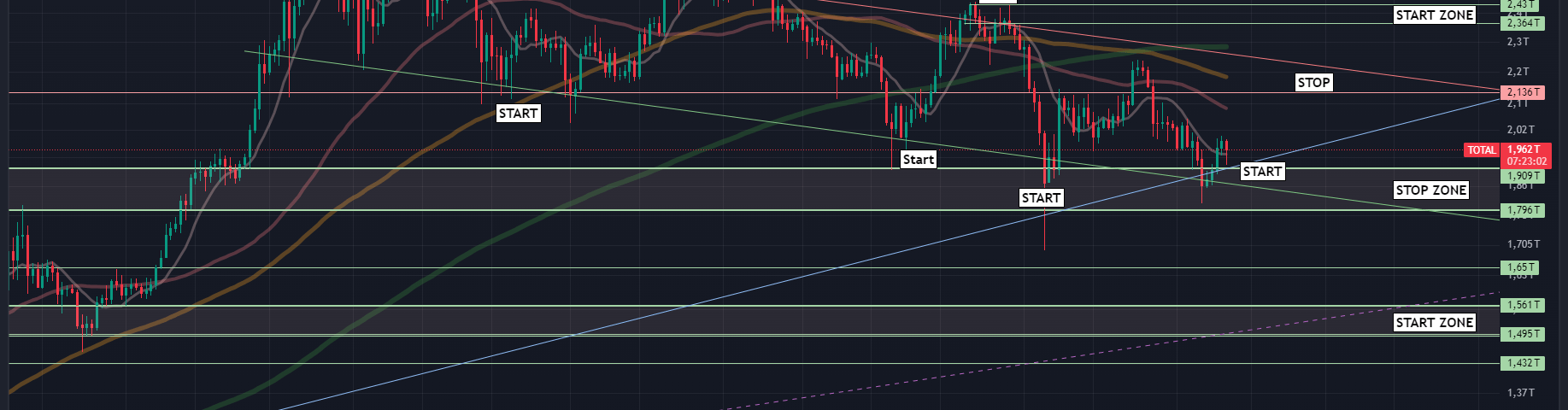

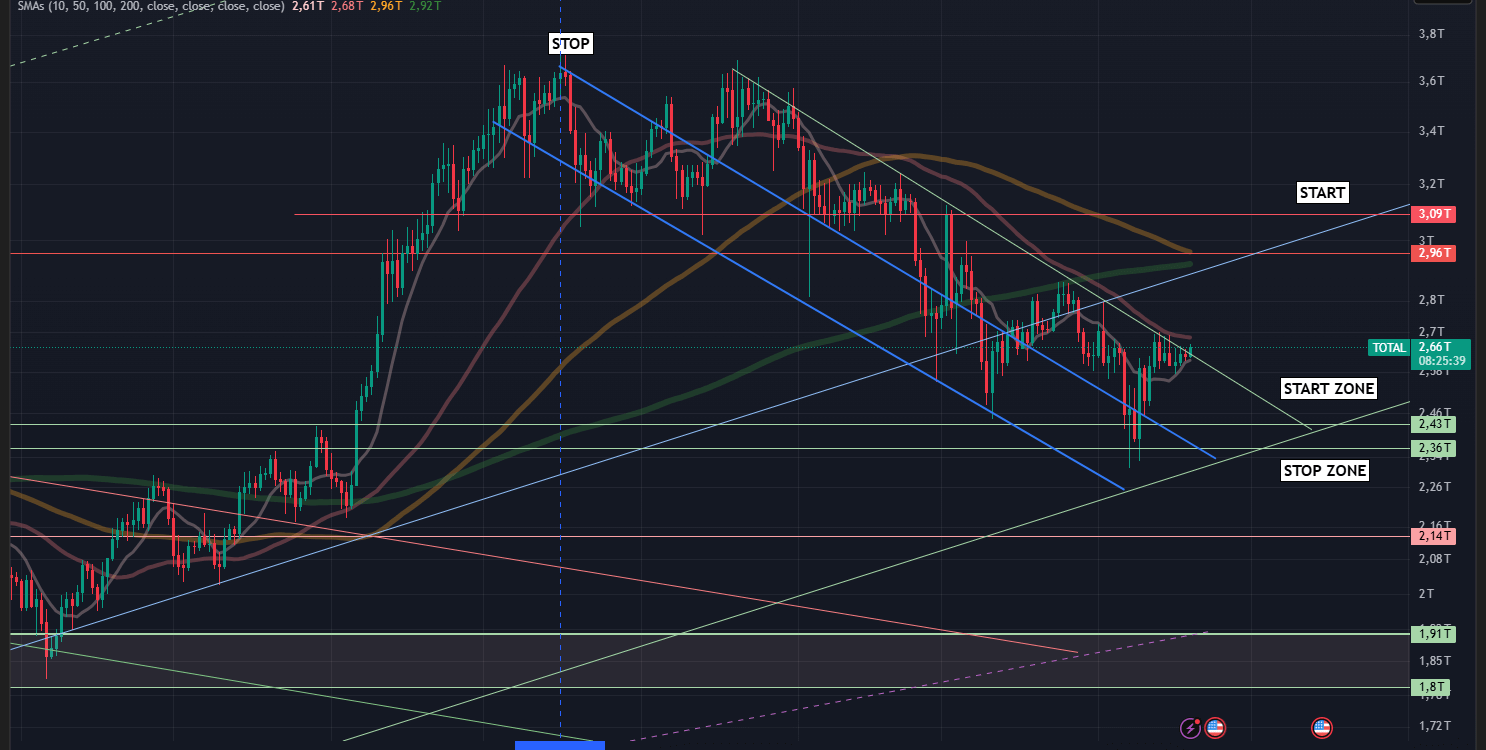

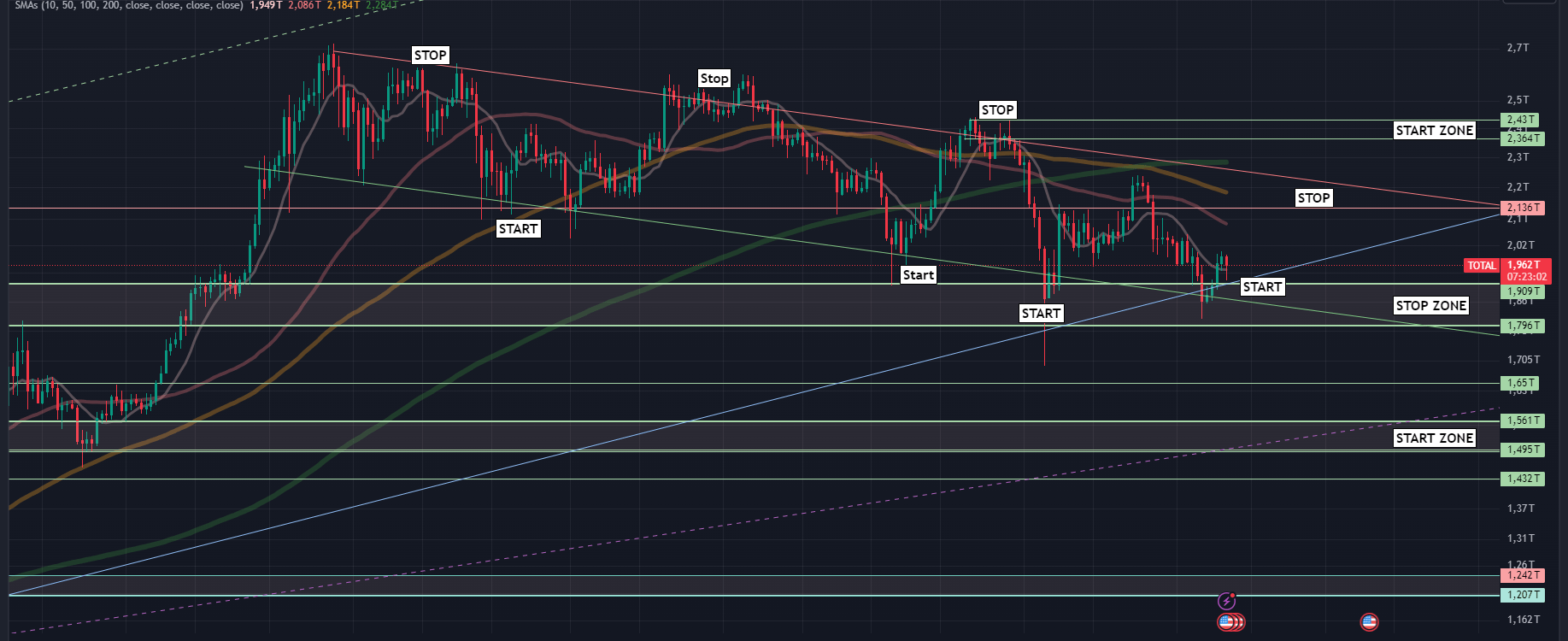

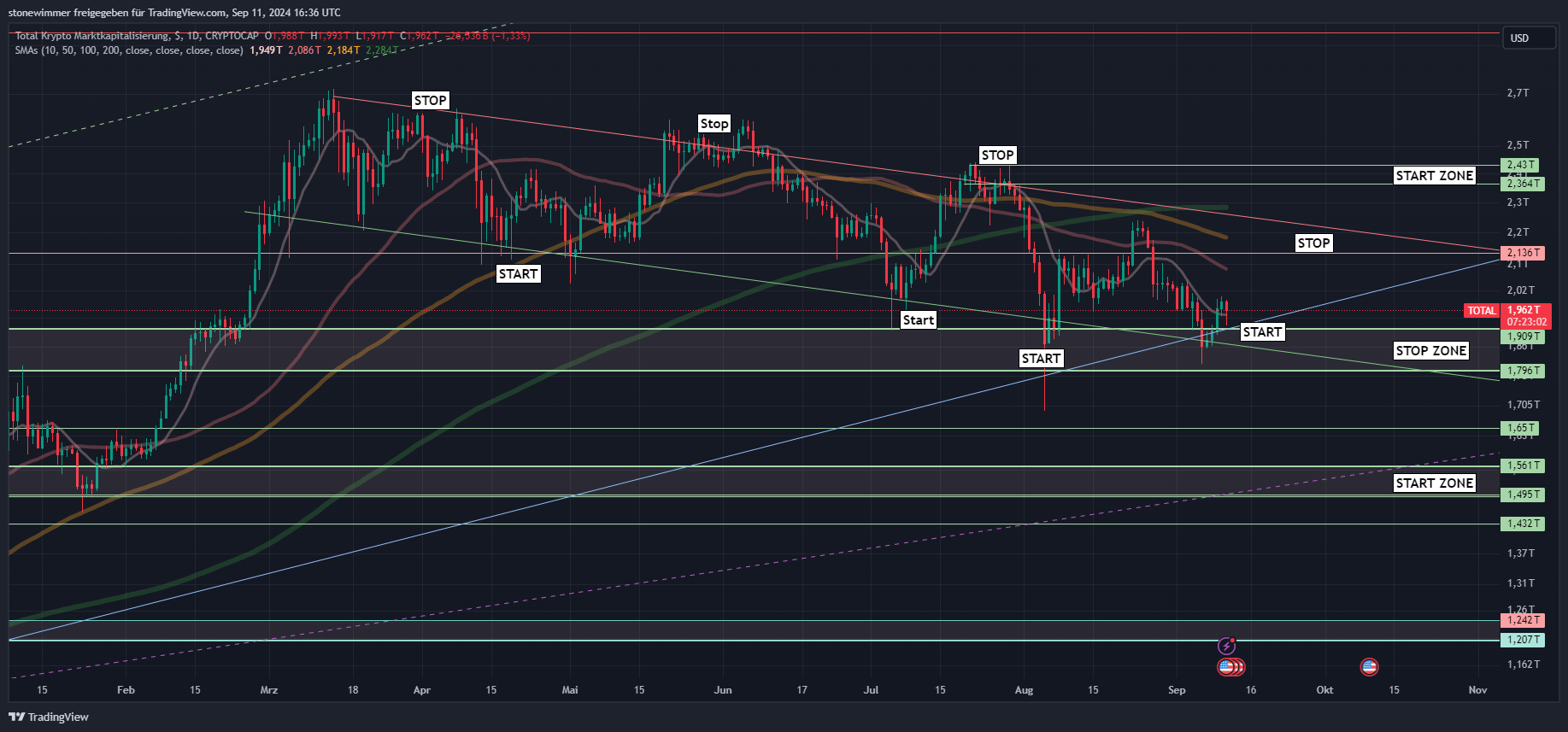

Through in-depth market analysis, we determine the optimal moments to switch our trading robots on or off. The chart illustrates the market's downtrend since March 2024, depicted by a color-coded trend channel, with lower support lines and upper resistance lines. Price movements occur within this channel. When the price approaches the upper resistance line, our trading system is paused. Conversely, when the price hits the lower support lines, buy signals are triggered, and the system is reactivated.

Zone Analysis

Zones play a crucial role in the operation of our trading systems. For instance, if the price drops below the stop zone, we deactivate the system, as the likelihood of further price declines increases. Conversely, we identify start zones where the probability of price increases is higher. However, it is not always necessary to trade immediately when a zone is reached—additional factors are key to making this decision.

Macroeconomic Influencing Factors

Macroeconomic factors, such as central bank meetings or the release of economic data, are also critical when deciding whether to activate or deactivate a trading system. These events can impact specific market conditions and confirm the validity of trend channels.

Based on the width of the trend channel, we define exit scenarios, which can vary in tightness depending on the market conditions. If the trend channel is too narrow, we pause the trading system until a clearer market picture emerges. Individual assets may experience rallies even during a broader market correction. However, when the overall market reaches upper resistance zones and begins to sell off, these signals indicate the end of such rallies. In such cases, we close open positions and halt the trading system.

Trend Changes and Breakout Scenarios

Occasionally, the market breaks out of a correction trend and begins an upward movement. In such instances, we closely monitor key price levels. These important thresholds provide us with signals for reactivating our trading systems, once they have been consistently surpassed.

Our advantages through automated trading!

- Precise and data-based decisions!

- 24/7 market monitoring and trading!

- Quick adaptation to market developments!

- Risk management and increased efficiency!