Market analysis and strategic deployment plan for trading robot Morai 1.5

20. April 2025The uncompromising one – MORAI, the signal robot from Quantum Data Analytics.

There are market phases in which clear trends are absent. Prices move sideways, rise slightly, and fall again. For many, this is an unpredictable environment – for Morai, it is the ideal terrain. Morai remains on the positive side in every market situation. During a correction phase, it builds positions at favorable prices, and when prices rise, it converts these positions into realized profits. It is not a system that blindly follows the markets, but a precisely tuned tool that brings structure and discipline into every decision.

Morai is a trading robot that operates with clearly defined strategic rules. It unfolds its particular strength in market phases with low trend dynamics, that is, when many other systems react indecisively. It is not an independent market actor. It trades exclusively on the accounts of our clients and only when they have explicitly activated their API connection. Full control of the account always remains with the client. All decisions are based on data and algorithms, not on emotions or short-term sentiment.

The principle Morai follows is simple yet effective. It uses two opposing market phases for the same purpose – achieving a positive result. In market corrections, it builds positions when prices are lower. In upward movements, it sells these positions and realizes profits. Thus, it is not dependent on guessing the market direction but works systematically in both scenarios. This approach reduces dependence on sustained trends and makes it more resilient to volatile market conditions.

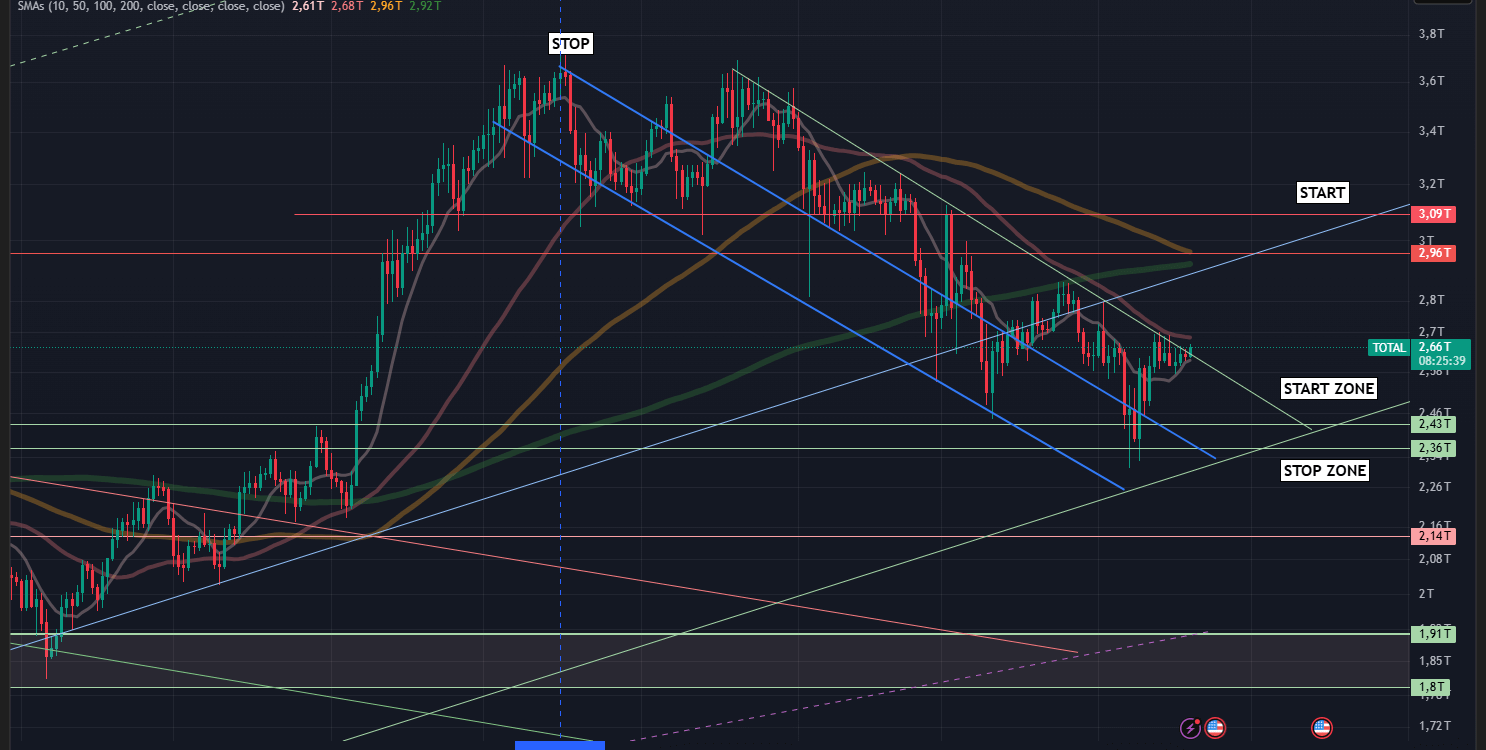

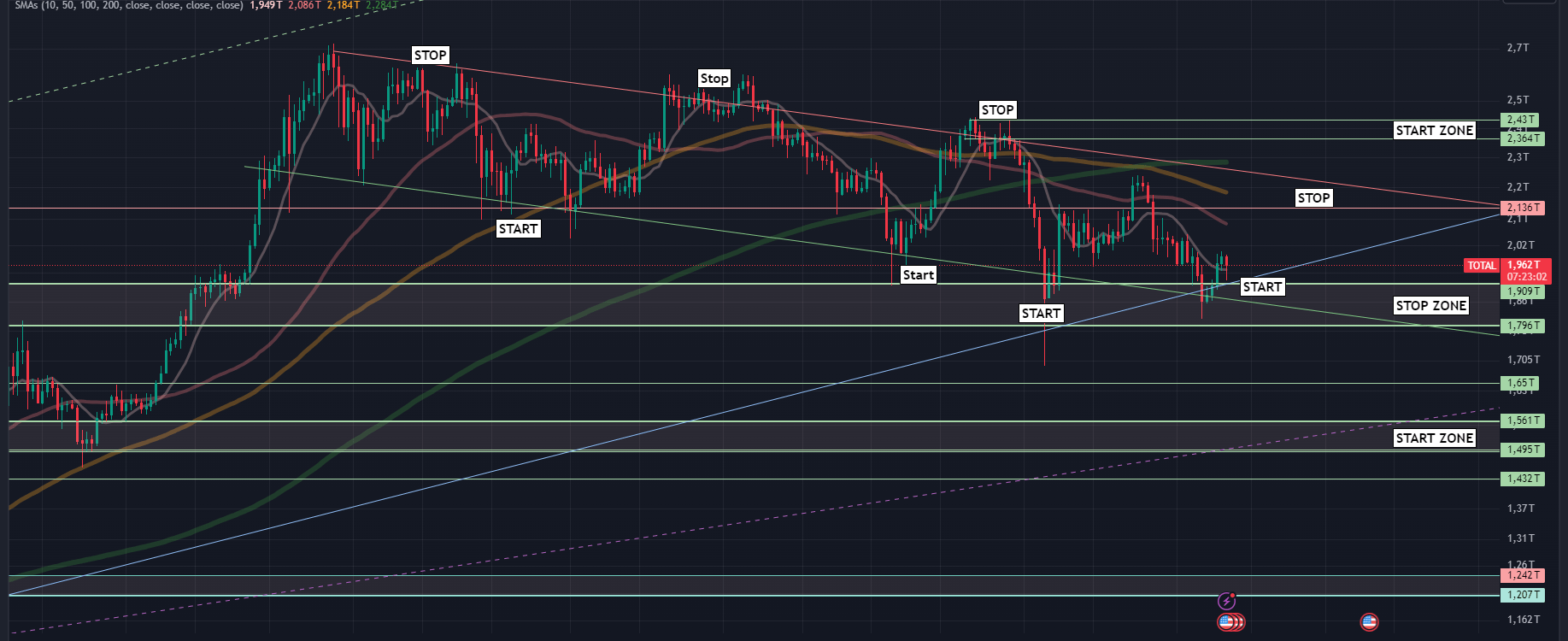

Morai’s trading decisions are based on a triple-indicator structure operating on short timeframes. Each of these indicators analyzes the market independently, without relying on cyclical patterns or past phases. An entry occurs only when all three indicators simultaneously confirm a Cross Over – the crossing of two signal lines, where a faster line cuts through a slower one from below. This simultaneous confirmation across all three indicators is considered a strong statistical signal for an impending counter-move or trend reversal. The exit follows the reverse principle. It is triggered either when the predefined profit range is reached or when the indicators signal a negative Cross Over. This way, profits are protected and losses consistently limited.

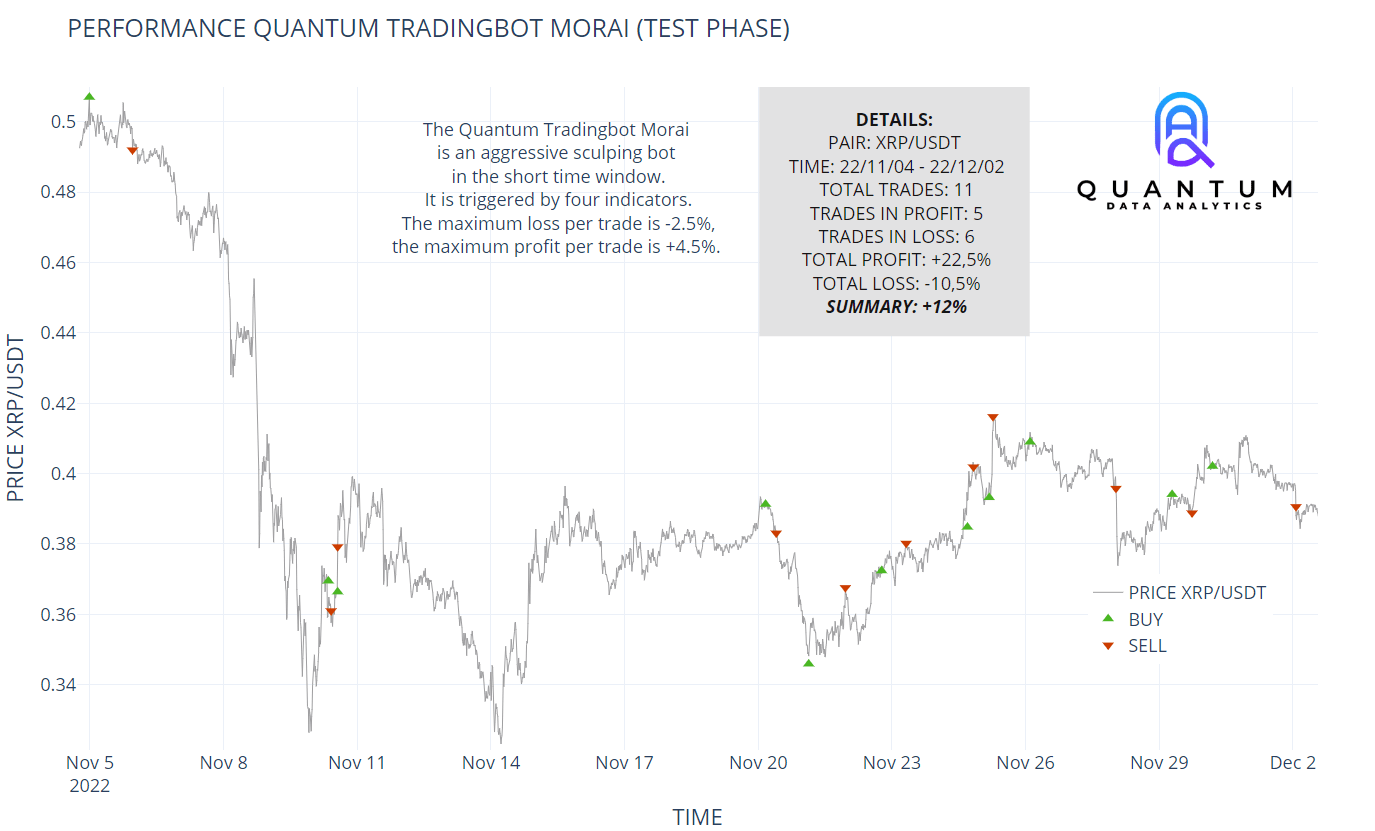

Risk management is an integral part of Morai’s architecture. Every position has a clearly defined risk. The maximum drawdown per trade is flexible but is by default limited to minus 2.5 percent. Profit-taking is oriented toward a target range of up to 6.3 percent but is dynamically adapted to current market conditions. In low-volatility markets, smaller profits are realized more quickly, while in more dynamic markets, positions may run longer. Security and flexibility go hand in hand here.

In addition to its trading logic, Morai features a multi-layered security architecture. The Trailing Stop Loss ensures that the stop price automatically adjusts to rising prices, thereby securing profits while controlling risk. For extraordinary situations, Morai is equipped with a panic button that can be activated in the event of technical malfunctions or external incidents. At that moment, an independent secondary protocol takes over, immediately closing all open positions regardless of the primary trading logic. This way, capital remains protected even when unforeseeable events occur.

Morai is not just a single trading system but part of a centralized technology platform by Quantum Data Analytics. With one trading robot, we coordinate strategies for all connected client accounts simultaneously. When Morai identifies a trading signal, it transmits it in real time to all accounts, where it is executed in accordance with each client’s individual parameters. This model combines the efficiency of centralized analysis with the security of decentralized account management. Each client retains full control of their account, while Morai ensures that all benefit from the same strategic advantage. In this way, we create a system that is scalable, transparent, and future-proof – without ever requiring access to client funds.

All values and parameters mentioned serve exclusively to explain functionality. They do not represent a promise of future returns. Past performance is not a reliable indicator of future results. Morai is a technical system that generates signals based on market indicators. Execution takes place solely on client accounts and under their full control.