AI IN SYMBIOSIS

WITH

HUMANS

Through well-founded, data-driven insights, AI supports informed decision-making processes and minimizes the risk of wrong decisions.

Technical ANALYSES!

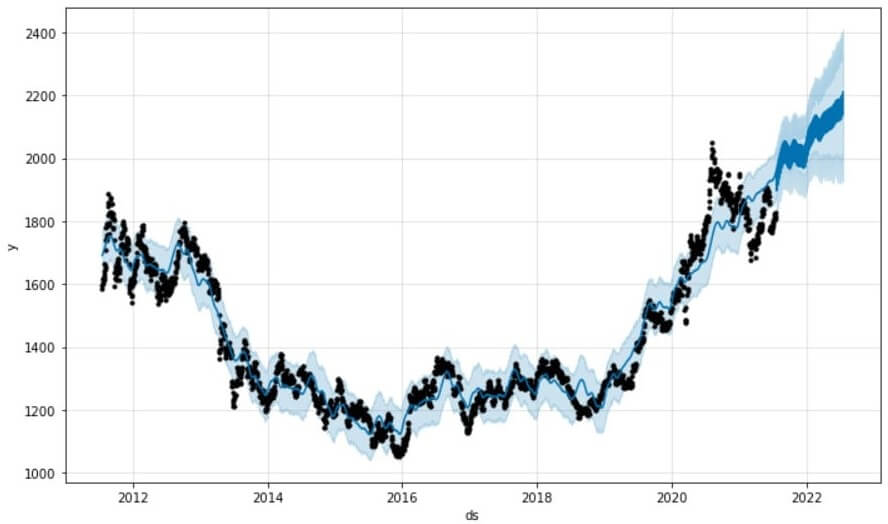

AI can analyze massive amounts of data and detect patterns that are difficult for human analysts to identify, leading to more accurate market forecasts.

What AI can do – and what it cannot

Artificial intelligence is currently a central topic and will most likely remain so in the foreseeable future. In our work, we focus intensively on the application of AI in both data analysis and trading. As a result, we have in-depth knowledge of the potential AI offers—and of its limitations.

Artificial intelligence cannot definitively predict exact prices for tomorrow, next week, or the coming years. Markets are too complex and often too impulsive for that, and the required computing power as well as the handling of the necessary data are extremely demanding. However, AI can identify probable price ranges with a high degree of accuracy by using trend channels, trend strength, and moving averages. Based on historical experience, AI can indicate the direction in which the market may technically develop in the near future. In addition, AI continuously improves its capabilities. All AI systems we use are developed entirely in-house.

AI enables the continuous monitoring and real-time analysis of market data, allowing us to respond more quickly to changes in market conditions.

2

Trend Strength

Through machine learning, artificial intelligence is able not only to generate trend channels but also to forecast trend strength. This is achieved by analyzing the relationship between trading volume and price developments. These trends are often seasonal and repeat in specific cycles. As a result, AI can project potential trend intensities within channels, which is helpful for identifying possible trend reversals.